Canada Post service disruption is in effect. Please call us if you need assistance. Intact Insurance clients: easily access your documents through the app or Client Centre.

AccèsConseil joins the Ellipse Group. We are joining forces to better serve our clients and grow our teams. Read the official press release

Budgets in Canada and Quebec have been announced. When it comes to financial strategies, Canada announced that it will now be possible to withdraw $35,000 from registered retirement savings plans (RRSPs) to buy or build a first home, as part of the Home Buyers’ Plan (HBP), a $10,000 increase.

The Registered Disability Savings Plan (RDSP) becomes more flexible when the beneficiary has lost its invalid status; they won’t be forced to close their plan anymore. A new type of plan will also be allowed under tax rules: the Advanced Life Deferred Annuity (ALDA). This is very good news, and I will follow up on this topic as soon as tangible products start materializing.

Quebec is eliminating the subprime for Early Childhood Centres based on household income and is increasing Investissement Québec’s budget to finance Quebec-based businesses. /p>

What is the inversion of the yield curve?

The US government's 10-year bond yielded a 2.439% coupon on Friday, March 22, less than the US three-month equivalent, which closed at 2.442% that same day. This is called the inversion of the yield curve. Short-term rates provide a better return in interests than long-term ones. The only logical explanation is a forecast of economic slowdown in the next few years by investors. This reversal phenomenon became global in the days that followed, and Canada was no exception. The situation was reversed six days later.

How should one respond to such signal? Previous recessions were preceded by an inversion of the yield curve for 10 consecutive days, as underlined by Bianco Research. The inversion matters less if the 10-year return rises rapidly above the three-month return. Which is exactly what just happened.

And even if the yield curve remains inverted for 10 days or more, it is probably not relevant. According to Bianco Research, the last six times this has happened for a long period, between 140 and 487 days passed before the recession hit. Therefore, even if a 10-day inversion is probably a sign of problems to come, it is not so useful to predict the exact timing of the storm.

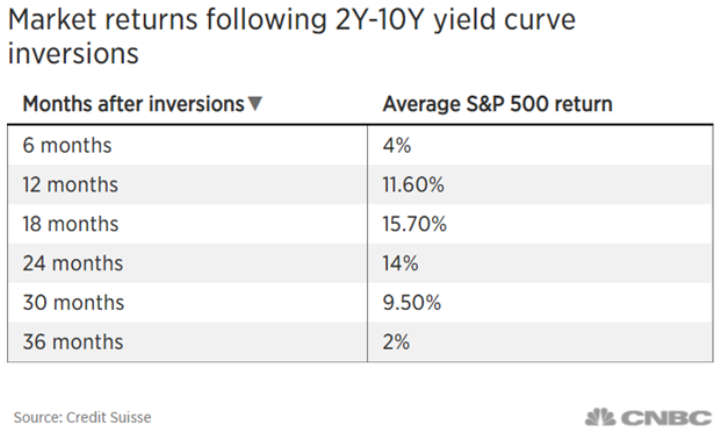

What’s more, the stock market returns between the moment of the inversion and the recession have been historically very good on average. See the table below (the recession hits on average two years after the inversion):

American Stock Market

The S&P 500 Index has been going up for a month, around 2,900 points. Job creation has been very good once again in March in the United States. In this context, it is difficult to imagine a recession since job creation is so vigorous.

Please note that this statement reflects my opinion and does not constitute investment advice. Each person’s unique financial situation will affect their appropriate choices.

I invite you to send me your questions, to which I can respond in the next newsletter for the benefit of all.

Dynamique Weekly update– March 22, 2019

Barron’s magazine – March 22, 2019

Stock Market eNewsletter - Week of March 25, 2019 (Mackenzie)

The Investment Junction – April 2019 (Myles Zybloc)